You might be surprised to learn that young people fared so well in the battle to get ahead in 2023.

In fact, every age group saw gains. But the real question is, how do they translate that momentary gain into a better life today and the retirement of their dreams tomorrow?

Most people think, “Easier said than done.” But it’s really not too hard – if you understand discretionary income and know what to do with it. You need a plan.

This article explores how discretionary income (DI) changes over time so you can plan effectively and reach the goals you set.

Key concepts

- Discretionary income measures your ability to reach financial goals.

- DI peaks in middle age and normally decreases with age.

- Plan your finances to be sustainable now and in the future.

The 2024 DI Index Study

The average American found it a little easier to make ends meet in 2023. According to the most recent data from the Bureau of Labor Statistics, after-tax income grew faster than non-discretionary expenses during the year. As a result, people were left with more discretionary income in their pockets.

At Frugal Gnome, discretionary income is used to measure true wealth. It shows how much financial freedom you have by subtracting non-discretionary expenses from after-tax income. What’s left over is your DI, i.e., the money you can use as you please – which may mean anything from a weekend in Vegas to saving for the future. That’s discretionary income.

A decade of data

We have to go back to 2023 for the latest data, but following changes over time gives a good indication of how economic conditions affect consumers and what impact this has on different age groups.

In 2023, the average DI for adult Americans grew by 3.13%. That’s a little below the 10-year average gain, but at least it reversed a trend which had seen DI decrease for each of the prior two years. The biggest gain in DI was made by adults under age 25 – a welcome boost for a group whose average DI is only about a third of the average for adults overall.

DI trends over time

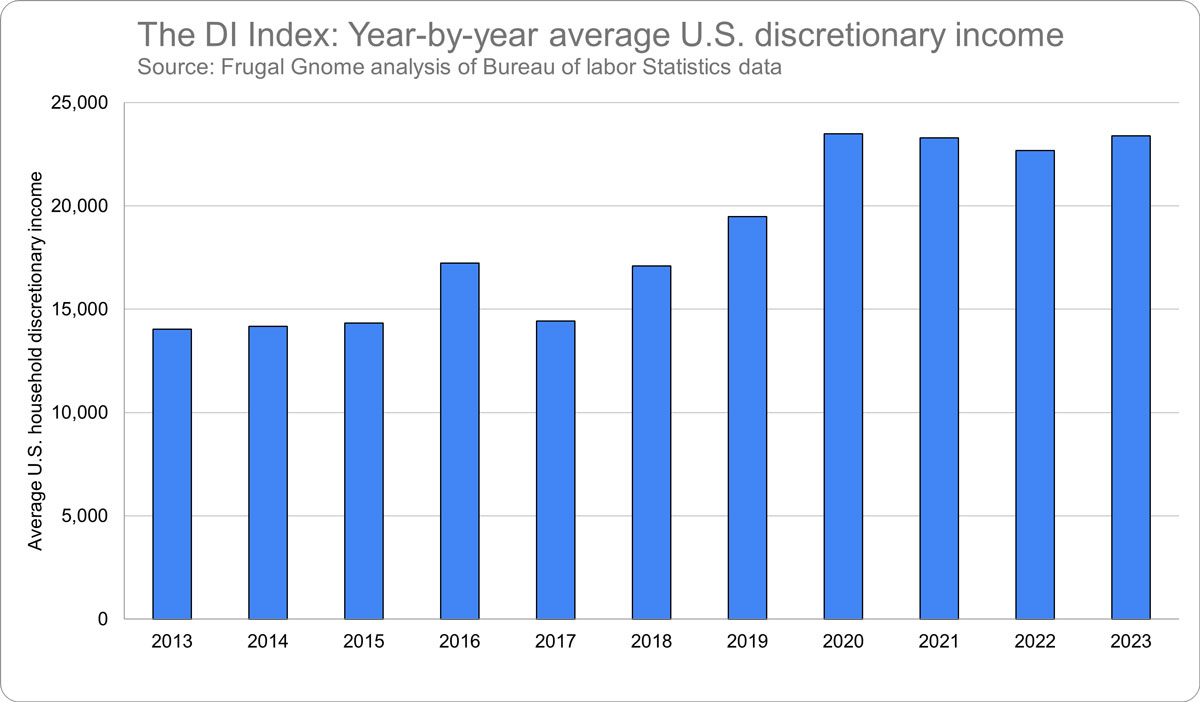

In general, the past ten years have seen the DI of American consumers make steady progress. Here’s a look at the year-by-year change in average DI:

DI has risen in most of the past ten years, with the exceptions of a significant setback in 2017 and smaller declines in 2021 and 2022. Overall, the average DI increased by 66.67% over the past ten years.

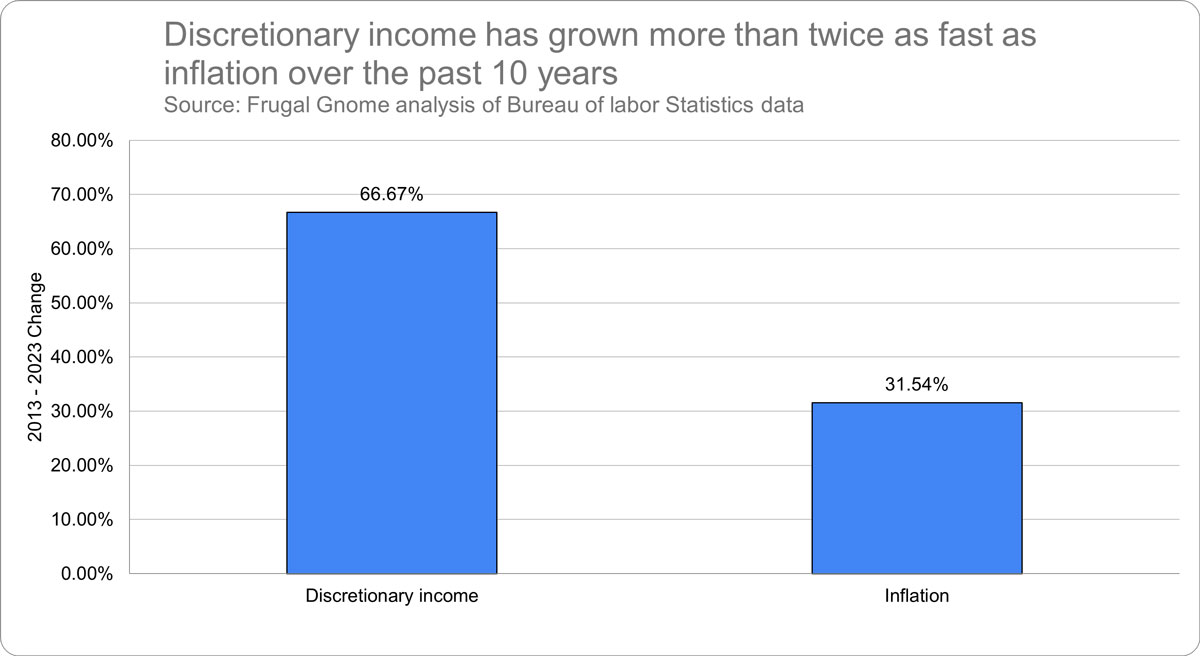

This means that DI has grown more than twice as fast as consumer prices over those ten years:

Growth in DI during 2023 and over the past 10 years shows that Americans in general have been getting ahead.

Exploring the breakdown: Growth of income and non-discretionary expenses as housing costs rise

The two components that determine DI are:

- After-tax income

- Total non-discretionary expenses

DI declined in 2021 and 2022 despite the fact that after-tax income grew in each of those years. That’s because non-discretionary expenses grew by more. In 2023, DI was able to grow by 3.13% because after-tax income grew by $4,674, while total non-discretionary expenses grew by just $3,965.

In dollar terms, the biggest increase in non-discretionary expenses for Americans in 2023 was a $1,138 rise in average housing costs. These costs are also the biggest single expense for most Americans, representing an average of $25,436.

As long as your after-tax income exceeds non-discretionary expenses, you will have some discretionary income. If you can widen the gap between the two, that’s when you’ll see an increase in your DI.

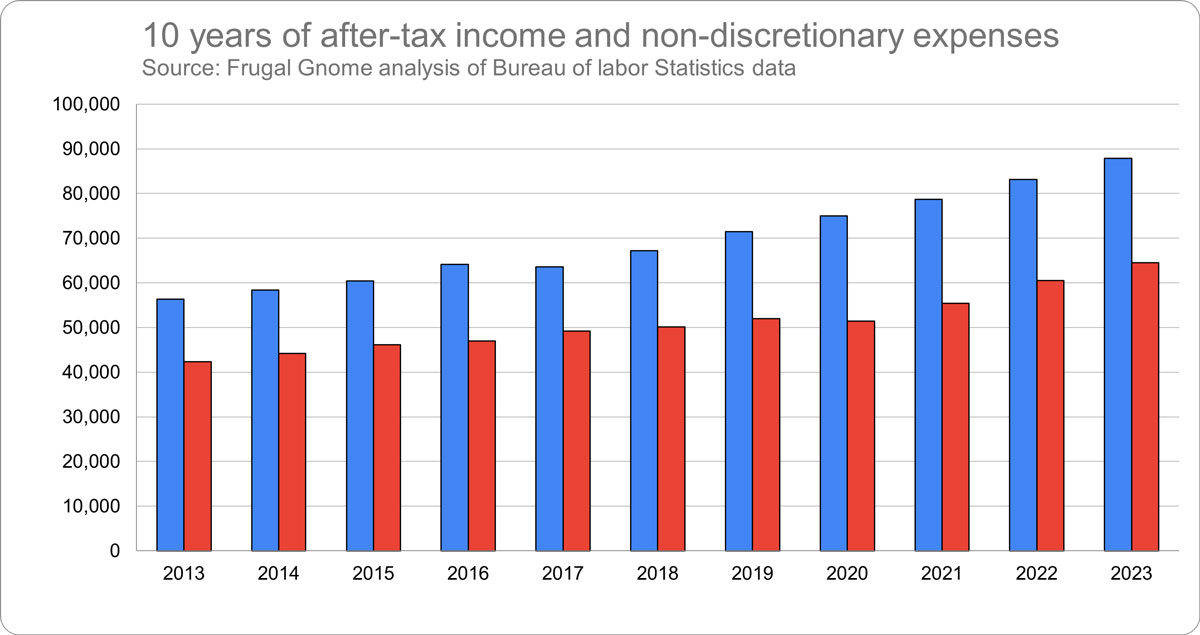

For the average American consumer, here’s how the relationship between after-tax income and total non-discretionary expenses looked over the past 10 years:

DI grew over those 10 years for two reasons:

- After-tax income grew by 55.93% during that time.

- The income growth exceeded the growth of non-discretionary expenses. Those expenses increased by 52.37% over the same period.

This highlights the two things you can do to increase your DI over time. One is to increase your income. The other is to control your necessary expenses and financial obligations so they grow more slowly than your income.

Growing your DI gives you more choice over how you use your money. That represents a true increase in your wealth.

What to expect: How DI changes with age

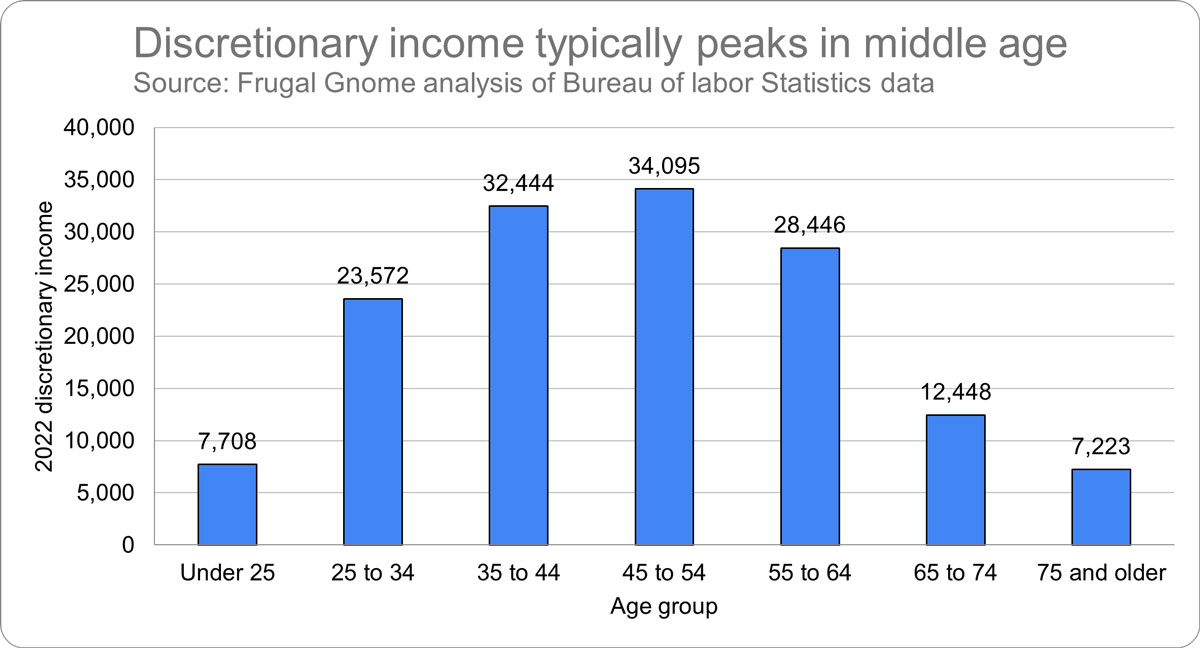

As you plan for your future, it’s important to know how DI is likely to change as you age. Here is the average DI for seven age groups:

While young adults generally have a hard time making ends meet, they experienced the fastest growth in discretionary income in 2023. Discretionary income for adults under 25 grew by 19.26% in that year, compared to 3.13% for adults overall.

Still, discretionary income is hardest to come by for the youngest and oldest adults. It typically rises rapidly as you approach middle age but then starts to fall off sharply through your retirement years.

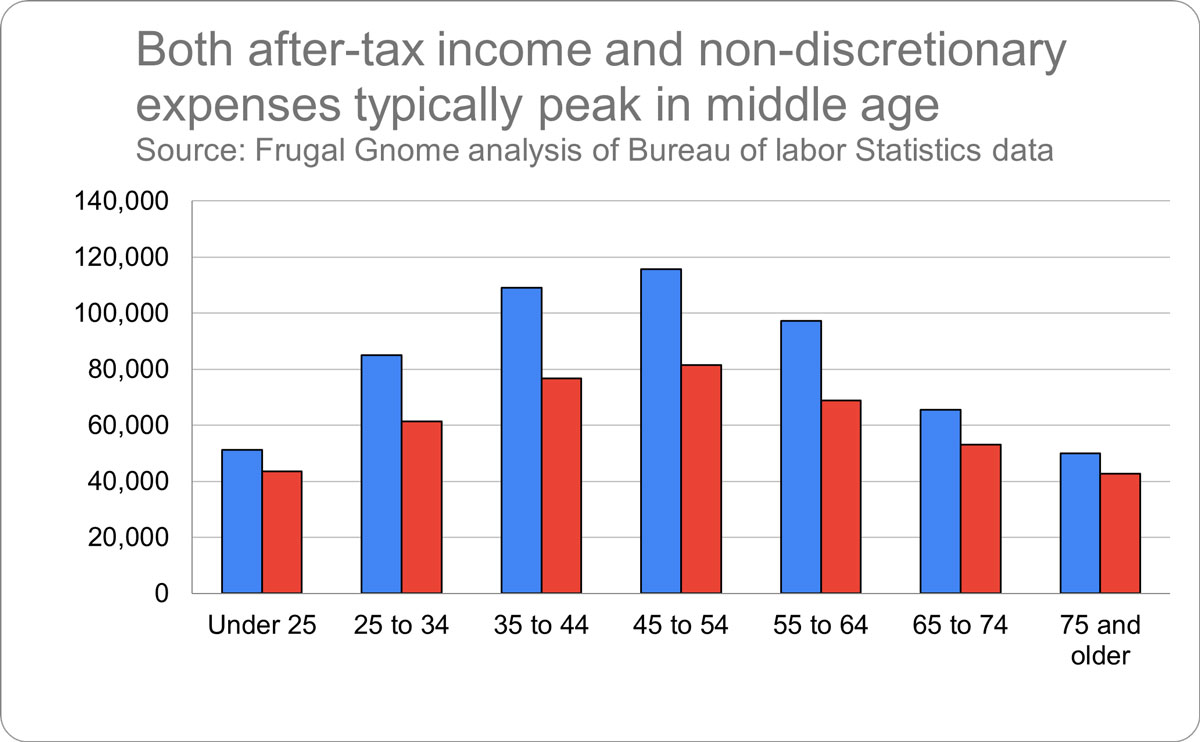

Splitting out the after-tax income and non-discretionary expense components of DI provides a better sense of how this dynamic works over a person’s career:

As you can see, both income and expenses tend to rise rapidly in the first few decades of your career. However, once you reach your mid-50s income is likely to start to fall. It’s important at this point to start to cut expenses significantly, so your discretionary income won’t be completely wiped out.

Connect the dots: How you budget affects your DI

Throughout your career, look for opportunities to grow your income. At the same time, work to control expenses so they never rise as quickly as your after-tax income.

In particular, be careful about taking on recurring expenses after you get a financial windfall like a bonus or a tax refund. That’s income you may not receive every year, so you don’t want to take on expenses that rely on it.

It’s the same story with investment gains. Remember that investments rise and fall over time. If your investments have a good year, don’t raise your expenses to match what might turn out to be one-time gains.

Retirement planning: Use DI to your advantage

Knowing how DI changes over one’s lifetime, you can develop a strategy to work with this normal course of events:

- Save earlier for retirement. DI typically starts to fall off once you reach age 55, so you’ll be in the best position to save for retirement in the years leading up to that. Take advantage of your peak DI years by getting ahead of schedule in your retirement savings.

- Eliminate financial obligations ASAP. Given how income and expenses fall off from age 55 onward, you should try to minimize financial obligations that will extend beyond that point. For example, it’s wise to pay off your mortgage and other loans before your income starts to decline.

- Imagine a sustainable future. For both loan payments and expenses in general, keep in mind that someday you are likely to have to support your lifestyle on a smaller income. Try to keep your expenses as flexible as possible, so you can adjust as your income changes.

Because we only go through life once, people are often taken by surprise by how their income and expenses change over time.

Seeing how average incomes and expenses affect DI for different age groups can help you anticipate what could happen in the years ahead. In effect, it is a glimpse into the future that can help you make more effective plans for retirement.

Be strategic: Start your subscription

Yes, you can get answers to your financial questions online. But how do you know which one works for your situation?

Frugal Gnome’s mission is to help you eliminate guesswork when it comes to your finances. Our goal is to help you learn how to use financial principles to your advantage with targeted education and tools that model your decisions.

For a limited time, a $0.99 monthly subscription gets you unlimited access to three pathways on the Frugal Gnome site, including articles and tools that help you plan for lifetime financial security. Please join us on the journey to build fantastic finances. We’re rooting for you!

Methodology

Frugal Gnome used consumer expenditure data from the BLS to calculate average DI figures. This includes after-tax income and those expenditures deemed by Frugal Gnome to fall into the category of “necessary expenses and minimum obligations.”

There are some lifestyle choices inherent in those expenditures, so they don’t represent the bare minimum necessary to get by. For example, the decision to buy a bigger house or live in a more expensive neighborhood may result in a larger mortgage payment. While this would represent a choice rather than an absolute necessity, it would create an ongoing financial obligation. Thus, it would be subtracted from after-tax income in calculating DI.

All figures are based on the BLS definition of a “consumer unit.” This may be one or more persons living together and dependent on the same financial resources.

Sources:

- Consumer Expenditure Surveys, Demographic tables, Age of reference person 2013 - 2023

Bureau of Labor Statistics

09-25-2024 | Accessed: 11/5/2024 - Consumer Price Index for All Urban Consumers (CPI-U)

Bureau of Labor Statistics

Accessed 11/5/2024