Preparing for retirement is a marathon, not a sprint. But many put off decisions around retirement because they don’t know how to build wealth.

This path explains the pros and cons of two major investment strategies used to plan for retirement.

The interactive needs assessment helps you create an action plan so you can navigate the various aspects of either method depending on your budget, priorities, and goals.

Guiding Principle for Planning Retirement

Invest DI to provide DI in the future.

How the Path Works

Learn it.

- Explore the pros and cons of different ways to build wealth for retirement.

- See how to define what life in retirement looks like and how much it costs.

- Discover how to future-proof your investments against economic trends.

Plan it.

- Create your budget and your investment strategy to build wealth.

- Use our calculators to model and compare different financial scenarios.

- Research investments, financial advisors, and insurance options.

Do it!

- Start investing and set ROI milestones to reach at various ages.

- Select a fiduciary to help advise on investment decisions as needed.

- Monitor your investments and explore new opportunities as they arise.

TIP: You only have a limited time to prepare for retirement, so it’s important to start planning as early in life as possible.

Topics Covered

The Plan for Retirement Path addresses how much to save to provide for the three stages of retired life:

- The active years

- The relaxing years

- The caring years

The process is multi-faceted and depends on what retirement looks like for you. The articles, guides, and financial tools are designed to help you identify your needs, maximize your return on investment, and learn to manage costs to reach the goal.

In most cases, the process covers similar topics such as:

- How much retirement savings should I build?

- When should I take social security?

- What are the advantages of a health savings account (HSA)?

- How to decide where to live in retirement.

- Do I need to be out of debt before I retire?

- How does inflation impact my investments and ability to retire?

Frequently Asked Questions

How will I afford medical expenses in retirement?

Everyone should take advantage of government insurance plans (Medicare and Medicaid). Then, depending on your discretionary income, add on the type and amount of supplemental insurance that meets your needs and expectations.

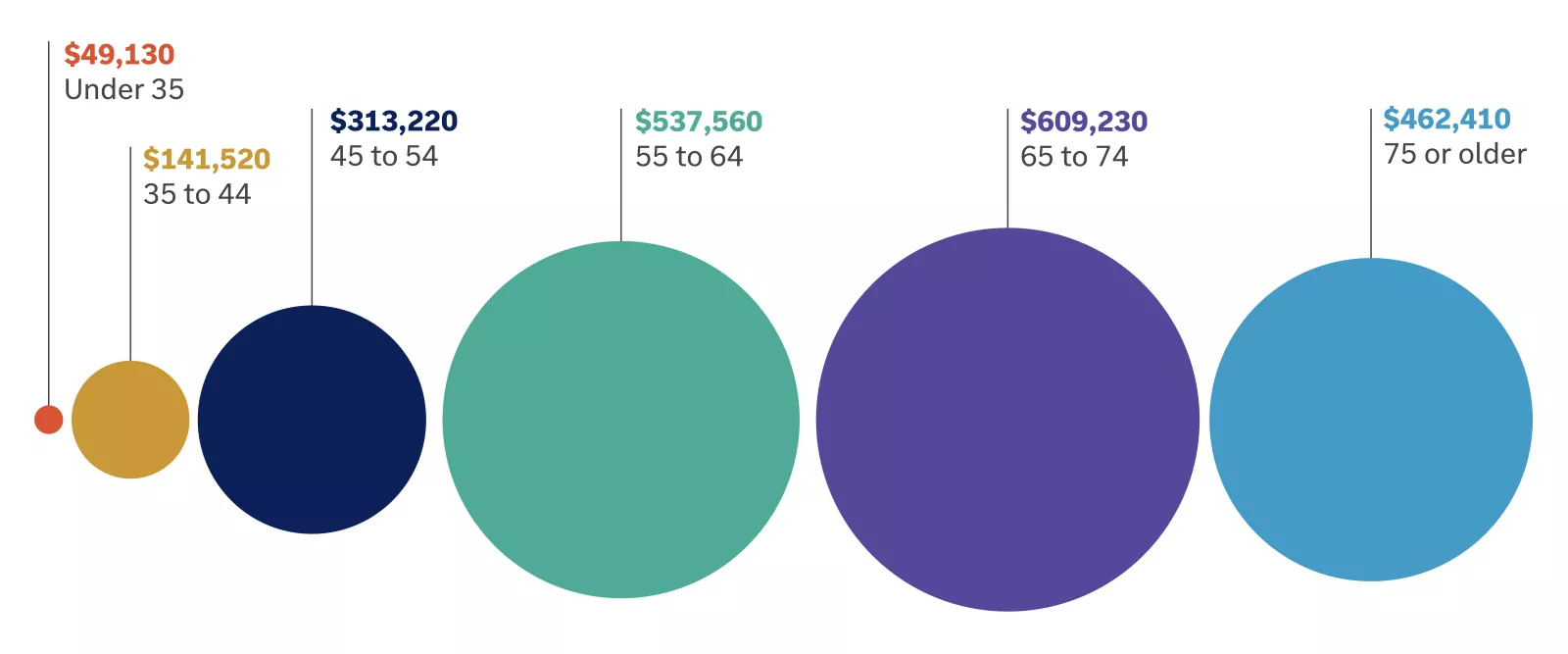

Is what I’ve saved for retirement normal for my age?

According to Edward Jones [1][2], the breakdown of retirement savings at various ages is:

Source: Federal Reserve Survey of Consumer Finances, 1989-2019; https://www.federalreserve.gov/econres/scfindex.htm [1]

Sources:

- What is the average retirement savings balance by age?

Katherine Tierney, CFA, Senior Retirement Strategist, Edward Jones

Accessed: 12-05-24

Should I pay off my mortgage before retirement?

Whether you should pay off your mortgage before you retire depends on two things - your need for the funds and what you are getting for your investments versus your mortgage rate.

Simply, if your investments provide a higher return (after taxes) than the interest you’re paying on your mortgage, then you probably should not pay off the mortgage.

That said, there are situations where you might want to pay off the mortgage, such as when your financial situation is such that paying off your mortgage wouldn’t affect the lifestyle you are enjoying.