When it comes to investing, should you try to beat the market or is it safer to go with the crowd? That’s a multi-trillion-dollar question.

Active and passive investments each attract trillions of dollars from US investors alone. There is a long-standing debate as to which approach is better.

You should consider the attributes of both active and passive investing when deciding how to manage your money. The good news is, it doesn’t have to be an either/or decision. You can incorporate elements of both into your investment approach.

Trends in active vs. passive investing

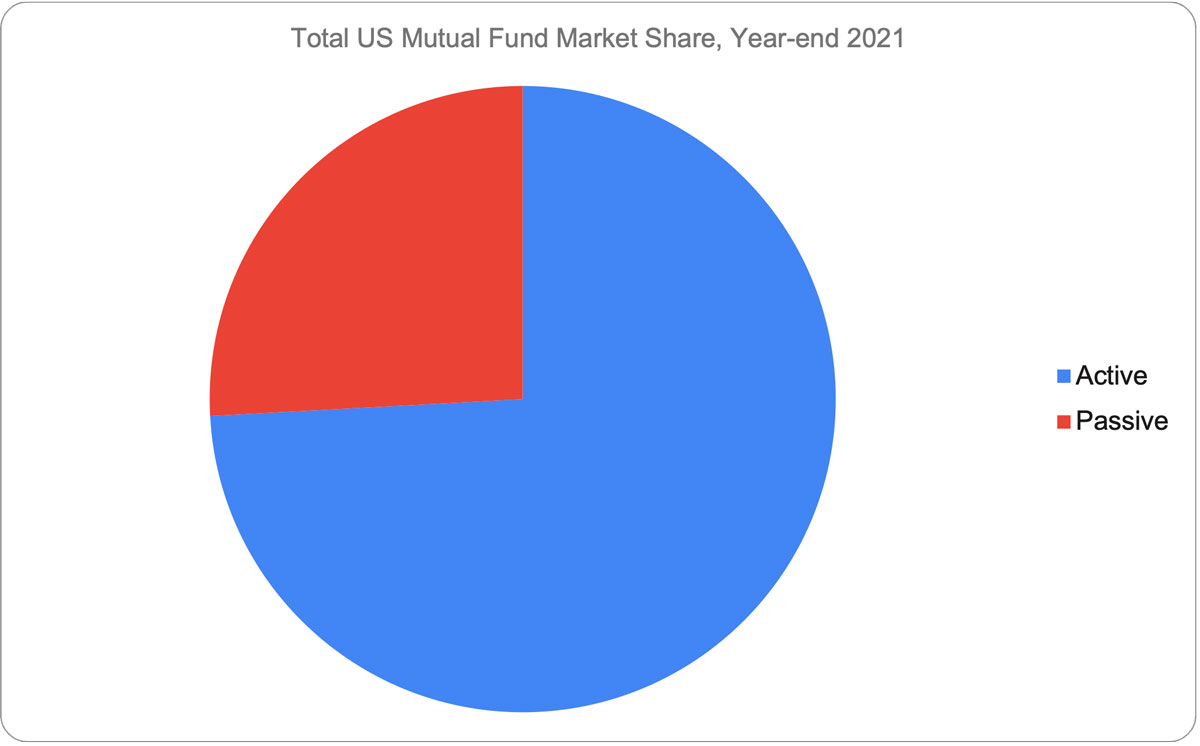

Passive investing has only come into vogue in recent decades, so based on assets in US mutual funds active investing is still more widely used:

However, while active funds have been losing investment dollars in recent years, passive funds have shown a net gain:

What do active and passive investing mean?

"Active investing" means consciously making decisions that differ from what the market as a whole is doing. Naturally, the goal of this is to do better than the market. "Doing better" may be defined as beating the market and/or managing risk.

"Passive investing" means imitating the market rather than trying to beat it. For example, instead of trying to do better than the S&P 500, you might decide to just own every stock in the S&P 500, in the same proportion as the component parts of the S&P 500.

Since passive investing is based on trying to mimic market indexes like the S&P 500, this approach is frequently referred to as “indexing.”

Active and passive investing are both broad categories that encompass many different specific investment styles. Some prominent examples of each are given in the sections that follow.

Comparing active and passive investing

The following table sums up some of the key contrasts between active and passive investing:

Active vs. Passive Investing

Active Investing

- Attempts to outperform the market

- Can vary greatly from market performance - for better or worse

- Can be used to hedge or reduce risk

- Can be adapted to market conditions, though this can backfire

- Relatively high fee structure

- May involve high turnover at times, leading to more transaction costs and taxable gains

- Can be used for tactical tax management, such as harvesting losses to offset realized gains

Passive Investing

- Reflects market returns - though that could mean any over several different markets

- Aims for low tracking error, which means performing in close step with a target index

- Generally involves taking full market risk

- Intented to provide full market exposure regardless of conditions

- Generally low fee structure

- Very low turnover under most conditions

- Generally lower tax consequences but no active management of tax liabilities

Examples of active investing

Active investment means being selective. Instead of just investing broadly in the market, active investors seek an edge.

As described below, there are different ways to pursue investments that might do better than the market as a whole.

Top-down investing

This means picking investments based on a big-picture economic overview. For example, if you think oil prices are likely to rise, you might favor investments in the oil industry and related sectors. You might also shy away from sectors that are heavily dependent on petroleum-based products and thus might be harmed by rising oil prices.

Bottom-up investing

This means picking stocks and other securities one by one, based on their individual characteristics.

Bottom-up investing involves intensive analysis of specific companies. You would look at a company’s business model and competitive positioning. You’d consider the supply and demand characteristics of its industries, and look at other economic factors that could affect the business.

Once you had a firm grip on the company’s prospects, you’d do some detailed modeling of its earnings outlook and compare how the value of its earnings stream would compare with the current price of the stock.

Active asset allocation

Of course, US stocks aren’t the only asset class. Besides expanding the pool of stocks to include those based in foreign countries, you also have the opportunity of investing in corporate bonds, federal government bonds, and municipal bonds.

You might also consider more specialized asset classes, such as commodities and real estate.

Each of these asset classes is affected by different things and will react positively or negatively to changing economic and market conditions. You can vary your asset mix to favor those classes of securities you believe are best positioned for emerging trends.

Sector and style rotation

Even staying within stocks, there are different sectors and styles from which to choose. You can actively manage the combination of these subclasses in your portfolio and rotate from one sector or style to another as you believe conditions dictate.

For example, if you feel a recession is coming, you might want to avoid sectors such as travel and luxury businesses. In an overpriced stock market, you might lean toward value rather than growth stocks.

Being able to adjust your portfolio characteristics according to company sectors or investment style creates many opportunities for active management.

Examples of passive investing

Since the goal of passive investing is to mimic a particular market, the idea is for your portfolio to be as representative as possible of that market.

This generally involves owning a large number of stocks, so passive investing is usually pursued through index funds, including exchange-traded funds (ETFs).

Although passive investing involves being broadly representative of a market rather than making specific choices to try to beat the market, there are still some decisions to be made. After all, given the diversity of investments available, there are many ways to define what the market is.

Below are a couple of examples of how this might affect how you structure your portfolio.

Broad market capture

People who seek a portfolio representative of the US stock market generally choose an index fund based on the S&P 500. Based on data from the Investment Company Institute[1], this single index accounts for 29% of all the money invested in US index funds.

Stocks in the S&P 500 represent over $30 trillion in market value, according to data from S&P Global[2]. So, it’s certainly a broad way to define the stock market. However, it isn’t the only way.

The S&P 500 is dominated by very large companies. To get even broader market representation, you might consider an all-cap index, which includes smaller and mid-sized companies.

Of course, the US is not the only market[3], so to take an even broader approach you might choose a global index which includes both US and foreign stocks.

Specialty market capture

Instead of taking a wide-angle view of passive investing, you might choose to target more specific market segments to comprise your portfolio.

This may involve concentrating your holdings in stocks of specific countries or regions. It might also involve targeting stocks in a specific size category, with small-cap, mid-cap or large-cap funds.

While passive investing is largely a hands-off process once you get your portfolio set up, there are still decisions to make in terms of how you structure that portfolio.

Key characteristics of active investing

While active investing can be approached in a variety of ways, there are some general characteristics of which you should be aware.

Performance goals

If the mission is to take a different approach from broad market participation, it’s especially important to identify the goals of that approach.

For example, while many people have it in mind to beat the market when they pursue active investing, there is more than one way to define outperformance.

Earning a higher return than a benchmark is one way to outperform, but you may also use active investing as a way to hedge or reduce risk. In that case, the idea may be to do better than the market in down markets.

Whether you are trying to earn a higher return than the market or manage risk, you should look at returns on a risk-adjusted basis. This takes into account both the return you earn and the amount of risk you took to get it.

Also, while active portfolios are designed to differ from the market, it is important to define just how different you’re comfortable being. The more your portfolio differs from the market, the more able you are to take advantage of opportunities and pricing inefficiencies in the market. At the same time, depending on your situation it may not be prudent to completely ignore basic principles of diversification.

Tax implications

Be prepared that active portfolios tend to trade more than passive ones, and thus may incur taxable gains more frequently.

However, this disadvantage is negated when you use an active approach within a tax-advantaged portfolio like a retirement account.

Expenses

Because active portfolios trade more often and require more intensive decision-making than passive portfolios, they are generally more expensive when it comes to trading costs and management fees.

When evaluating an active approach, it’s important to evaluate whether the past results and future potential are worth the added costs.

Key characteristics of passive investing

Here are some things to be aware of when taking a passive investing approach:

Low tracking error

When you choose to mimic a certain index, make sure the fund or other vehicle you use stays as close to that index as possible.

When evaluating an index fund, look for a statistic called tracking error. This measures the extent to which past performance has deviated from the performance of the target index. Also consider the fund’s methodology for keeping its holdings in line with those of the target index.

Tax consequences

The constituents of indexes don’t change that often, so passive portfolios tend to have low turnover. This means less frequent taxable events.

However, income from indexed holdings is taxed, so income-based approaches might see a higher portion of their returns taxed. Finally, a fund that experiences heavy outflows of money may be forced to liquidate investments, triggering tax consequences even for people staying in the fund.

Expenses

The low turnover and less intensive decision making of passive funds means they generally cost less than active approaches.

Incorporating active and passive investing into a portfolio

Final thought: Active and passive investment styles are not mutually exclusive. You can incorporate both into your overall investment approach.

For example, you may choose a passive approach for most of your money to ensure broad diversification, but still set some money aside to actively pursue certain opportunities. Or, in an active top-down approach, once you’ve decided what sectors to invest in you may use indexed sector funds to efficiently capture those sectors.

In any case, be sure you know the characteristics of each type of approach when choosing which is right for the job you want done.

Financial intelligence at your fingertips: Start your subscription

We hope you enjoyed this article.

Making big financial decisions can be tricky – and time-consuming if you’re accustomed to searching online for answers. The odds are against your finding anything other than cookie-cutter guidance designed to fit everyone’s financial situation – not yours.

Frugal Gnome takes a different approach. We teach the principles behind effective personal finance so you learn how to build wealth given your situation, priorities and goals.

You can do it yourself, saving money and time. Join us with a special offer.

For a limited time, a $0.99 monthly subscription gets you unlimited access to three pathways on the Frugal Gnome site, including all the articles and tools you need to lay a great financial foundation so you can build wealth. Please join us on the journey to build fantastic finances. We’re rooting for you!

Sources:

- 2022 Investment Company Fact Book Data Tables

Table 42, Table 43 on pg. 207, 208

Accessed: 01-03-25 - S&P Dow Jones Indices – U.S. Market Cap

S&P Global - Overview

Accessed: 10-31-23 - Passive Likely Overtakes Active By 2026, Earlier If Bear Market

Bloomberg Professional Services

Published: 03-11-21 | Accessed: 10-31-23, 12-26-24